Trying out this year’s tax-preparation software was like wandering through a bazaar: Everybody was trying to sell me something I suspected I didn’t need.

TurboTax pressed me to buy its MAX benefits, promising “total peace of mind.” H&R Block urged an upgrade to Best of Both, so one of its tax professionals could review my return. And TaxAct coaxed me with its Protection Plus audit assistance. These add-ons, of course, cost extra.

Maybe the tax software companies are trying to distinguish themselves with something besides their return-preparation programs — because, though the three offerings aren’t interchangeable, they’re not different enough to recommend one over the others for a straightforward return.

All three will carry you through a return that includes wages, mortgage interest and real estate taxes, a few investment accounts, charitable gifts and even the occasional oddity like the purchase of an electric car or solar panels. In a world of personal drones and driverless cars, it has been a long time since tax software has seemed revolutionary, though it does still ease a tedious task.

My tryouts suggested that the differences between TurboTax and Block were smaller than in the past. TurboTax used to stand out with its ease of use and technological polish, while Block provided better help. This year, Block sharpened its technology — it even beat TurboTax on a critical task, uploading a prior year’s return — while TurboTax improved its telephone helpline. TaxAct kept doing things its own quirky way, as it long has, but it capably handled the basics.

One thing that hasn’t much changed this year is pricing. TurboTax still charges a premium. Block aims at the middle of the market. And TaxAct offers a comparative bargain. I tried out each provider’s top-level online option. (They also sell downloadable software.) In early February, TurboTax was charging $89.99 for its Self-Employed edition; Block, $54.99 for its Premium; and TaxAct, $37 for its Premium. All three charged about $35 for each state return. Prices can change during tax season.

The add-ons ratchet up the fees. TurboTax’s MAX benefits, for example, cost an additional $59.99 in early February. That charge entitles users to help if they’re audited or if someone else files for a tax refund in their name. They also receive “priority care” when they call, as well as identity-theft monitoring. TurboTax says the services have a value of $117 — a hard-to-verify claim since it doesn’t sell them separately.

The real enticement here, of course, is the audit help. Few things in life are as dreaded as the prospect of arm-wrestling with the I.R.S.

Jennifer L. Blouin, an accounting professor at the Wharton School at the University of Pennsylvania, cautioned that many do-it-yourself filers may not need the protection.

Audits are rare, and the I.R.S. focuses its efforts on complicated returns, like those filed by businesses or people with lots of self-employment income, who file I.R.S. Schedule C, she said. “I suspect that many of the issues for a Schedule C filer pertain to adequate record keeping,” something audit assistance is unlikely to help with, she said.

Professor Blouin added that the frightening word “audit” can cover everything from in-person interrogations to a simple exchange of letters. She said she once forgot to include one of her husband’s I.R.S. 1099 forms on their return. The I.R.S. sent a letter, noting the omission and asking for the missing tax and interest. She agreed and sent a check — for $37. Still, a worrier might want to pony up for audit assistance, she said: “Maybe the $50 is cheaper than a prescription to Ambien,” the sleep aid.

Contents

TurboTax

My biggest worry in testing TurboTax was more workaday than an audit. It was trying — and failing — to transfer information from my wife’s and my prior-year TurboTax return to this year’s program. When I tried, I got a message saying that the file wasn’t a tax file — it was — or that it had been corrupted. I wondered whether my browser, Chrome, was interfering, so I switched to Safari. Same result. I couldn’t upload the PDF copy of our return because TurboTax’s online software doesn’t allow that. Later, I tried uploading the return to the downloadable desktop version of TurboTax’s software. That worked, but don’t ask why — I’m the sort of person who regards technical smarts as being able to change the settings on my phone.

Successful data transfers can spare you hours of toil and eyestrain. When they work, they fill your return with much of the prior year’s information that might repeat, such as personal details, varieties of income reported and charities contributed to.

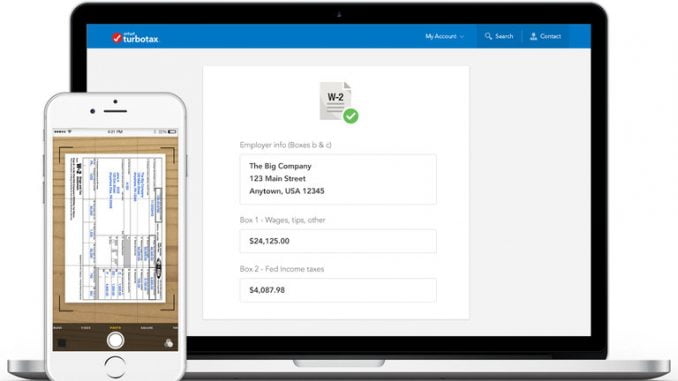

TurboTax also imports wage data from larger employers and financial information from bigger banks and investment companies. While I couldn’t pull information from my own prior return into this year’s TurboTax online program, the imports from those outside sources worked as smoothly as ever — details from our employers and from Vanguard and T. Rowe Price zipped right in.

Technology has long been TurboTax’s forte. Each year, it offers some new feature competitors don’t quite match. This year, it was an Apple Watch app. My reaction was this: Will Siri do my return if I mumble to my wrist? Will people on the subway think I’ve lost my mind? I tried out the app, and it underwhelmed — it just tells you the status of your federal and state returns, the amount of your tax liability or refund and the number of days until returns are due.

In my past assessments, TurboTax has sometimes lagged H&R Block in the area of technical help on confusing tax questions — in particular, I’d found its “live” help harder to use.

I had a question this year about logging in a contribution to an individual retirement account for a self-employed person. I was working online on my tablet and chose the option of receiving a telephone call from an expert. I got a message saying I’d hear back within five minutes. A gentleman from TurboTax called within two. He suggested that I return to my desktop computer and search “SEP Accounts” to find the “jump link,” which would take me to the place where I should enter the information. That solved my problem.

H&R Block

If TurboTax closed the help gap this year, Block reciprocated by beating TurboTax on the transfer of last year’s return. As with TurboTax, I couldn’t upload the prior year’s tax file. But Block gave me the option of uploading a PDF, and that worked. The program also vacuumed up our wage and investment information.

As in the past, I found Block’s explanations the clearest; that’s where Block’s long history in the tax-return preparation business — it also runs a chain of about 12,000 retail outlets — shines through. The guidance prompted me to include legal expenses I’d incurred to incorporate in 2016. I’d neglected to log those into TurboTax. Once, it even managed to amuse me, warning against trying to deduct “expenses for a facility, like a yacht or hunting lodge, that’s mainly recreational.” Do people with yachts do their own taxes?

But Block’s tax sophistication can sometimes stupefy. The program gave me four options for a depreciation method for my new desktop Mac. I went with the default, having no idea what the terms “GDS vs. ADS” or “regular vs. straight-line” meant. The software suggested that I take the GDS (General Depreciation System) regular method, which gives the quickest write-off. (Note to the I.R.S.: It wasn’t me!)

Later, the program also asked, “How are you feeling about your taxes?” I assumed that the possible answers would be (a) anxious, (b) annoyed or (c) on the verge of casting my laptop into Boston Harbor (yes, I live nearby). Instead, it offered anodyne choices, including “I need help.” I opted for that, and the program then offered Best of Both for $79.99.

With this service, a Block tax professional will review your completed returns. You can select the person, even seeing a picture. I picked Amy Brown, in nearby Acton, Mass., and learned that her hobbies included knitting and beekeeping. It felt like Block had merged with Match.com. Maybe that’ll be next year’s new service: have your taxes reviewed over cocktails or coffee.

One thing Ms. Brown, or any Best of Both professional, wouldn’t be obliged to do was represent me in person at the I.R.S. if I were audited. Block used to promise to provide audit representation for anyone who used its software. But this year, it began selling that service separately, for an additional $19.99.

If TurboTax is the tech-savvy sophisticate and Block the wholesome suburbanite, then TaxAct is the rowdy outsider. Its website promises to give users an “unfair advantage” and help them with “opportunistic navigation of the United States tax code.” They’re even encouraged to tweet out their desire to #BeatTheSystem.

With that rallying cry, I expected TaxAct to show me tax shelters or help me set up offshore accounts. Instead, it offered up the usual questions about income, expenses and life’s changing circumstances.

Once again, the online transfer of our old return faltered. The program said it could upload a PDF, but I tried three times, over two days, and failed. I kept getting a message saying the importing capability was down for maintenance. TaxAct did upload our W-2s but didn’t pull in our interest and investment income. (Shaunna Morgan, a TaxAct spokeswoman, said the latter capability would be available later in February.)

TaxAct structures its questionnaire differently than TurboTax and Block do — it asks, for example, about estimated tax payments near the beginning — but the major categories covered are necessarily the same. Besides sources of income, the questions address such matters as dependents, mortgage interest and charitable contributions.

At the end of TaxAct’s federal section, there’s a fascinating feature: TaxWatch. It breaks down the federal government into categories, such as national defense and Social Security and Medicare, and gives the percentage of federal spending each accounts for. It then takes those percentages and applies them to your tax liability to tell you that you paid, say, $5,000 worth of interest on the national debt in 2016.

When I see this, I want to know more. Is it really possible that, together, defense and retiree programs account for 60 percent of federal spending? How much, I wonder, are my wife and I personally paying for the Smithsonian and the National Zoo? What about the national parks? And might next year’s software have a feature in which I can direct my taxes toward my favorite government departments? That could be an add-on worth paying for.