Apple Pay launched in the UK on 14 July 2015. In this article we answer all the other questions UK readers are asking about Apple Pay and its UK launch: how Apple Pay works; how to set up and use Apple Pay; which UK shops and retailers support the Apple Pay service; Apple Pay security; and likely launch dates for Apple Pay in other European countries.

We’re also very interested in when each UK bank, building society and credit card will support Apple Pay. Until now the biggest mystery has been Barclays, the last major UK bank to adopt the Apple Pay service – but there’s good news on that front in our dedicated section When will Barclays get Apple Pay?

If you’ve got any more questions about the Apple Pay service or its launch here in the UK, let us know on Twitter or post them to the comments below. And don’t forget to answer our poll: Are you going to sign up for Apple Pay?

For Macworld’s verdict on the service, read our Apple Pay review.

Also read: Apple rumours and predictions for 2016

Main sections in this article:

- Apple Pay launch details

- UK banks & credit cards that support Apple Pay (updated, 5 April 2016, with the news that Barclays has launched Apple Pay support!)

- UK shops that support Apple Pay

- Apps that work with Apple Pay

- How to set up and use Apple Pay

- Apple Pay security, privacy and fraud

- Which Apple devices support Apple Pay?

- Alternatives to Apple Pay

Contents

- 1 Apple Pay UK launch: Apple Pay UK launch details

- 2 Poll: Have you used Apple Pay?

- 3 Which UK banks and credit cards support Apple Pay?

- 3.1 When will my UK bank or credit card get Apple Pay: American Express

- 3.2 When will my UK bank or credit card get Apple Pay: Bank of Scotland

- 3.3 When will my UK bank or credit card get Apple Pay: When will Barclays get Apple Pay?

- 3.4 The bPay factor

- 3.5 When will my UK bank or credit card get Apple Pay: Clydesdale Bank

- 3.6 When will my UK bank or credit card get Apple Pay: Co-operative Bank

- 3.7 When will my UK bank or credit card get Apple Pay: Coutts

- 3.8 When will my UK bank or credit card get Apple Pay: First Direct

- 3.9 When will my UK bank or credit card get Apple Pay: Halifax

- 3.10 When will my UK bank or credit card get Apple Pay: Harrods Bank

- 3.11 When will my UK bank or credit card get Apple Pay: HSBC

- 3.12 When will my UK bank or credit card get Apple Pay: Lloyds Bank

- 3.13 When will my UK bank or credit card get Apple Pay: M&S Bank

- 3.14 When will my UK bank or credit card get Apple Pay: MasterCard

- 3.15 When will my UK bank or credit card get Apple Pay: MBNA

- 3.16 When will my UK bank or credit card get Apple Pay: Nationwide

- 3.17 When will my UK bank or credit card get Apple Pay: NatWest

- 3.18 When will my UK bank or credit card get Apple Pay: RBS

- 3.19 When will my UK bank or credit card get Apple Pay: Santander

- 3.20 When will my UK bank or credit card get Apple Pay: Tesco Bank

- 3.21 When will my UK bank or credit card get Apple Pay: TSB

- 3.22 When will my UK bank or credit card get Apple Pay: Ulster Bank

- 3.23 When will my UK bank or credit card get Apple Pay: Yorkshire Bank

- 3.24 Apple Pay participating banks: Which US banks support Apple Pay?

- 3.25 Banks that support Apple Pay

- 4 Which UK shops and retailers will support Apple Pay?

- 5 …and which US shops support Apple Pay?

- 6 Which apps let you use Apple Pay?

- 7 How to set up and use Apple Pay

- 8 How to use Apple Pay: How does Apple make money out of Apple Pay?

- 9 Apple Pay security: How does Apple Pay safeguard my privacy and protect me against fraud?

- 10 Which iPhones and other Apple devices work with Apple Pay?

- 11 What rival services will Apple Pay have to beat?

- 12 Why isn’t Apple Pay called iWallet?

Apple Pay UK launch: Apple Pay UK launch details

Apple Pay officially launched in the UK on 14 July 2015. A first tier of UK banks offered Apple Pay support immediately (including NatWest, Santander and Nationwide), but a second wave will have to wait until later in the year.

Apple Pay’s UK launch came roughly nine months after the US launch of Apple Pay on 20 October 2014, as part of the iOS 8.1 update. Apple Pay saw 1 million activations in its first three days, according to Apple.

We’re not sure how quickly retailers will adapt to the service. The experiences of our colleagues at Macworld US suggests that it will take a few weeks for the training to kick in, and that the early days will see more than a few shop assistants (and iPhone owners) struggling to cope with the new technology.

Read next: How to use Apple Pay in the UK

Apple Pay launch date: When will Apple Pay launch around the rest of the world?

As a UK-based site, we were most interested in Apple Pay’s British launch. But we do have readers hailing from other nations, many of whom are keen to know when they’ll be able to use Apple Pay.

Canada & Australia

Apple Pay launched in the US first of all; here in the UK we were second to join the party. The service has since launched in Canada, and will launch in Australia on Thursday 26th November 2015. There is one caveat: in both Canada and Australia Apple Pay is available only for American Express customers.

Read more: Apple Pay coming to Canada and Australia this week, but only for AmEx users

Canada has long been ruymoured as an imminent Apple Pay launch venue. Back in April it was reported that Apple Pay was set for a Canadian rollout in autumn 2015, with the Cupertino company in talks with six Canadian banks.

My colleague Caitlin McGarry (writing from the US) reported that “Apple picked Canada as its test case for expansion for two main reasons: iPhones are incredibly popular up north and Canadian merchants have already moved to Near-Field Communication-equipped payment terminals, which Apple Pay requires.”

Belgium

A careless tweet from a Belgian bank recently suggested that, against expectations, that country might be the next part of Europe to start accepting Apple Pay.

KBC responded to an individual query by stating, quite matter-of-factly, that “this will be possible as of this summer. Have a nice day.” We wish other tech rumours could be dealt with in this sort of way.

@anthonynani Idd, dit zal vanaf deze zomer mogelijk zijn. Fijne dag nog.

— KBC Bank&Verzekering (@KBC_BE) May 20, 2015

Sadly, that eminently straightforward statement has since been retracted – but we’re not sure if it’s been retracted because the bank was mistaken in its belief that it would be able to offer Apple Pay as of summer 2015 (which seems unlikely), or if it got in trouble with Apple for spilling the beans. Here’s the retraction:

Apple Pay Rectification: KBC is constantly looking for new mobile solutions. Apple Pay is currently not yet in scope. Our apologies.

— KBC Bank&Verzekering (@KBC_BE) May 20, 2015

China

AppleInsider reports that a deal has been struck to bring Apple Pay to China.

Read next: How to use Apple Wallet to pay for things with your iPhone

Poll: Have you used Apple Pay?

Fellow UK Apple fans! Have you used Apple Pay yet? Let us know by answering our poll:

Which UK banks and credit cards support Apple Pay?

Pretty much all of the big UK banks have committed themselves to joining Apple Pay, although not all were part of the scheme when it launched in the UK on 14 July.

It was announced that American Express, First Direct, HSBC, NatWest, Nationwide, RBS, Santander and Ulster Bank would support Apple Pay at the UK launch, although HSBC and its subsidiary First Direct mysteriously dropped off the list at the last minute. They have since adopted Apple Pay support.

Then, on 11 September, Lloyds Bank and Halifax both announced that they were launching Apple Pay for their customers, and Bank of Scotland and MBNA added support earlier in August. TSB and Tesco Bank finally joined the scheme in November 2015. M&S Bank has joined too.

Barclays, the only major UK bank that didn’t commit itself when Apple Pay’s UK launch was first announced, later said it would join, and finally, many months after its rivals, launched Apple Pay support in April 2016.

Let’s look at those banks in a bit more detail and talk about their plans for joining – or not joining – the Apple Pay scheme. In alphabetical order:

When will my UK bank or credit card get Apple Pay: American Express

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

Here’s what we’ve been working on… https://t.co/kBFlY0j335

— American Express UK (@AmexUK) June 8, 2015

Read American Express’s Apple Pay web page for more details.

AmEx’s UK Twitter feed may provide more updates.

When will my UK bank or credit card get Apple Pay: Bank of Scotland

Confirmed by Apple as ‘Coming soon’ at the launch. Bank of Scotland wasn’t part of Apple Pay when it launched in the UK in July 2015. It is, however, now available for Bank of Scotland customers and you can find out more here.

When will my UK bank or credit card get Apple Pay: When will Barclays get Apple Pay?

The big name missing from the launch list was Barclays. At one point we said that “it would be a surprise if Barclays didn’t join Apple Pay by the end of [2015]”, but in very late March 2016 there is still no movement. This is a surprise as well as a disappointment; going by the results of our poll, above, plenty of people care enough about Apple Pay to switch banks to get it.

Updated, 5 April 2016: At long last, and quite surprisingly after last week’s suggestion that there would be further delays, Barclays has announced support for Apple Pay.

Not every kind of Barclays account is eligible for the scheme. “You can use Apple Pay with your Personal, Premier or Wealth debit card,” says the bank. “You can also use Apple Pay with your Barclaycard. Accounts that aren’t eligible include: Business, Corporate and Basic Current Accounts and accounts with ATM-only cards.”

More details on Barclays’ website.

Update, 29 March 2016: Over the long Easter weekend we passed the (unofficial) deadline that had been given to a customer by Barclays’ personal and corporate banking CEO, yet the bank’s customer still haven’t got access to Apple Pay.

Not happy with this state of affairs, one of Macworld’s readers complained to Barclays customer support and asked for an update – and then passed on the update to us. It’s disappointing news.

As you can see in the screengrabs below, rather than the late-March timeframe previously discussed by Mr Vaswani, the customer service rep could only apologise and state that “Apple Pay is expected to go live with Barclays in the next couple of months”, which translates to a very rough end of May. This after the same Mr Vaswani said the service would launch “very early in the New Year”, and after almost the entirety of UK banking managed to line up Apple Pay support in 2015. All very disappointing.

These are only segments of a longer chat conversation, which Macworld has seen. Our reader wished to be identified only as Bob; he also asked us to blur out the name of the (blameless) service rep.

Update, 26 January 2016: We’ve got a date for Barclay’s Apple Pay roll-out – sort of.

On 12 January, a Barclays executive responded to an emailed query from a customer by stating that the bank “will launch Apple Pay, as committed, within the next 60 to 75 days”.

Image courtesy of Oliver Foster-Burnell

Assuming the image shared is genuine – something we have no reason to doubt – then that would be Ashok Vaswani, the personal and corporate banking CEO who predicted the launch “very early in the New Year” back in October 2015 (see next section). But 75 days from the 12th Jan is Sunday 27th March, which hardly counts as very early in the year – nor would that be what most people would view as “shortly” after the October prediction – so customers would be forgiven for questioning whether this really consitutes Barclays fulfilling its commitments.

Nevertheless it’s great for Barclays customer to hear news of some kind from this quarter, and it could have been a lot worse. If Barclays hits the earlier launch date target – the company could be managing our expectations – then we’d be looking at a roll-out on the 12th March.

As a reader points out below, saying the service will launch “within the next 60 to 75 days” does not in fact specify that the launch will happen between those two dates, and suggests that it could have happened at any point before 27 March. At time of writing, however (9 March), it looks unlikely that Apple will beat the earlier of the two deadlines.

Update, 8 October 2015: Bad news, everyone. A disgruntled Barclays customer and blogger named Mike Jobson ran out of patience and emailed Ashok Vaswani, Barclays’ CEO of personal and corporate banking, to complain about the delays and to demand to know when Barclays would finally offer Apple Pay. Vaswani said that this would happen “very early in the New Year”.

You can read the full exchange on Mike’s blog.

Despite the positive spin that Vaswani attempts to put on this news – saying that he “hope[s] that you continue to bank with us particularly since we are launching this shortly” – this comes as a blow to the bank’s customers, who had been expecting the launch much earlier. Back in mid July, Macrumors had claimed that a Barclays executive expected to secure Apple Pay support imminently, and this hardly feels like that.

That wasn’t an official statement, of course, so it would be unfair to hold Barclays to that timeframe specifically, but the fact remains that the bank is months and months behind all of its rivals in the UK.

We’ll update this article if we hear any more on the Barclays Apple Pay rollout.

The bPay factor

In fact, Barclays may simply want to entice customers away from Apple Pay and point them towards its own bPay mobile payment service. This service works using a sticker that can be placed on the back of a phone, or through a keyfob, or even a wristband.

We can’t imagine many Barclays customers finding the bPay system more appealing than Apple Pay. It offers no extra security (Apple Pay has the Touch ID fingerprint sensor), and that means if you lose the sticker, wristband or keyfob anyone can use it for transactions up to £20.

What’s worse is that you have to pay £14.99 for the sticker, £19.99 for the keyfob and £24.99 for the wristband.

For more detail on bPay and its chances of taking down Apple Pay, have a look at Apple Pay vs Barclays bPay: Why Apple’s contactless payment system beats Barclays’ rival bPay service.

So much for bPay. But Barclays could still play ball with Apple, either in tandem with its own service or in preference to it if bPay doesn’t work out. Indeed, the bank insists that it’s still in negotiations with Apple about Apple Pay, and as we point out above, feels that this will bear fruit imminently.

One reader and Barclays customer, who got in touch and threatened to leave Barclays due to the lack of Apple Pay, claims to have received a reply that reads:

“We are in talks with Apple to incorporate the Apple Pay service within our app, so that our customers can take optimum advantage of the feature. As soon as an agreement is reached the feature will be incorporated to the Barclays services.”

Another Macworld reader emailed us with a similar story, although this time the Barclays spokesperson was less specific:

“Thank you for your email and even more importantly for being a long standing customer. We are in discussions with Apple and we should be able to announce the result of those discussions very soon.

“We are very committed to providing our customers with a broad choice of payment options to make their lives as easy as possible.”

On Twitter, Barclays responded to a series of customer queries about Apple Pay by saying: “Thanks for your tweets this evening. We can assure you that we’ve been talking with Apple about how our customers could use Apple Pay in addition to our existing mobile and payment services, and that these talks remain constructive.”

Thanks for your tweets this evening. We can assure you that we’ve been talking with Apple about how our customers (1/2)

— Barclays UK (@BarclaysUK) June 8, 2015

could use Apple Pay in addition to our existing mobile and payment services, and that these talks remain constructive. (2/2)

— Barclays UK (@BarclaysUK) June 8, 2015

Barclays is evidently desperately keen to at least give the impression that Apple Pay compatibility is a possibility in the future: we would imagine that the bank has been deluged with requests and queries from customers who want to use Apple Pay.

One disgruntled Barclays customer has gone so far as to start a petitioncalling on the bank to join Apple Pay, and for customers to boycott it and its bPay rival service until this demand is met. At time of writing that petition has only 148 supporters, although these things can always take off suddenly.

Barclays’ UK Twitter feed will provide more updates when/if the bank comes closer to an agreement with Apple.

When will my UK bank or credit card get Apple Pay: Clydesdale Bank

Neither a launch partner nor a listed partner under Apple’s ‘coming soon’ list.

We rang up the Clydesdale Bank and were told that the bank “is currently considering various opportunities to enable customers to take advantage of new & emerging payment options”. That probably means it’s waiting to see how successful the Apple Pay scheme proves to be in this country, and how vigorously customers protest against not being able to join in.

When will my UK bank or credit card get Apple Pay: Co-operative Bank

Neither a launch partner nor a listed partner under Apple’s ‘coming soon’ list.

We got in touch with the Co-Operative Bank’s press office to ask about its Apple Pay plans. “We are actively looking into our future participation with Apple Pay as part of our investment in Digital,” said a spokesperson for the bank.

The Co-op Bank’s Twitter feed is likely to break the story when/if the bank joins Apple Pay. You can also keep an eye on the bank’s website.

When will my UK bank or credit card get Apple Pay: Coutts

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015. The bank released the following statement:

“Coutts will offer clients access to Apple Pay, which is transforming mobile payments with an easy, secure and private way to pay, when it launches in the UK.

“The introduction of Apple Pay is another way Coutts is making it easier and more secure for customers to do their banking on the move, and just one of the bank’s recent digital innovations to make banking more convenient for clients.”

Read the rest of the statement here.

When will my UK bank or credit card get Apple Pay: First Direct

As an HSBC subsidiary, First Direct was on the list as an Apple Pay UK launch partner. And like its parent company, First Direct was mysteriously removed from that list on launch day. Based on HSBC’s statement, we expected First Direct to offer Apple Pay in the UK by the end of July.

Sure enough, First Direct customers are now able to use Apple Pay as of 28 July. Find out more here.

When will my UK bank or credit card get Apple Pay: Halifax

Halifax wasn’t part of Apple Pay when it launched in the UK in July 2015, but the bank said it will join in autumn.

As of 11 September, Halifax has indeed joined Apple Pay, and is rolling out support for its customers throughout the day. Find out more here.

When will my UK bank or credit card get Apple Pay: Harrods Bank

Neither a launch partner nor a listed partner under Apple’s ‘coming soon’ list.

We’ve got in touch with Harrods’ press office to ask about Apple Pay, and will update this when we get a statement from the bank.

In the meantime, keep an eye on the bank’s website for any announcements.

When will my UK bank or credit card get Apple Pay: HSBC

Oh, HSBC.

HSBC was originally slated as an Apple Pay UK launch partner, and we therefore expected the bank to offer Apple Pay support in the UK from 14 July 2015. But it did not do so.

One theory holds that HSBC lost its status as a top-tier Apple Pay partner as a punishment for leaking the service’s UK launch date beforehand. We’re not convinced by this, and there are plenty of practical problems that could have delayed the bank’s participation, but it’s one of those stories that’s too good to die: expect severe internal crackdowns on any leaks ahead of the next wave of banks joining Apple Pay.

The good news for the bank’s disgruntled customers is that the wait probably won’t be a long one. A spokesperson told the BBC that HSBC will join Apple Pay by the end of July.

Update, 28 July: HSBC now suports Apple Pay and you can find out more here.

When will my UK bank or credit card get Apple Pay: Lloyds Bank

Lloyds Bank wasn’t part of Apple Pay when it launched in the UK in July 2015, but the bank said it would join in autumn.

As of 11 September, the bank has now added support for Apple Pay, and you can find out more here.

When will my UK bank or credit card get Apple Pay: M&S Bank

M&S wasn’t part of the scheme when Apple Pay launched in the UK in July 2015 (although it was confirmed by Apple as ‘Coming soon’), but it has since announced that customers can use the service.

“M&S Debit and Credit Cards are eligible for Apple Pay, subject to status,” the bank says. More details here.

When will my UK bank or credit card get Apple Pay: MasterCard

Offers Apple Pay.

What’s more, from 23 November until 14 December 2015, MasterCard has offered to let its customers commute for free on London buses and tubes provided they use Apple Pay to tap in and out. Mondays only, but a nice way of getting people using the service. More details here.

When will my UK bank or credit card get Apple Pay: MBNA

Currently offers Apple Pay.

MBNA wasn’t part of the scheme when Apple Pay launched in the UK in July 2015, but it is now. The bank has all the details here.

When will my UK bank or credit card get Apple Pay: Nationwide

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

When will my UK bank or credit card get Apple Pay: NatWest

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

When will my UK bank or credit card get Apple Pay: RBS

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

When will my UK bank or credit card get Apple Pay: Santander

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

When will my UK bank or credit card get Apple Pay: Tesco Bank

Offers Apple Pay.

Tesco wasn’t a launch partner, but the bank confirmed it had joined in November 2015.

When will my UK bank or credit card get Apple Pay: TSB

Now offers Apple Pay.

We expected TSB to offer Apple Pay before the end of 2015 – it wasn’t part of the scheme when Apple Pay launched in the UK – and sure enough, TSB has since joined the party.

When will my UK bank or credit card get Apple Pay: Ulster Bank

Launch partner. Started supporting Apple Pay in the UK as of the launch on 14 July 2015.

When will my UK bank or credit card get Apple Pay: Yorkshire Bank

Neither a launch partner nor a listed partner under Apple’s ‘coming soon’ list.

As with the Clydesdale Bank, which is owned by the same organisation, we understand that the Yorkshire Bank “is currently considering various opportunities to enable customers to take advantage of new & emerging payment options”.

We’ll update the above list as and when the companies release more detailed statements concerning their Apple Pay plans. If your bank isn’t listed, leave us a comment at the bottom of this article and we’ll look into it.

Apple Pay participating banks: Which US banks support Apple Pay?

Obviously we’re most interested in the UK banks and building societies that will be working with Apple, but those planning trips abroard may be interested to know which US banks are on board with the scheme. This may also offer clues about the organisations that will adopt Apple Pay in other countries.

Apple Pay launched in the US with support from credit and debit cards from American Express, Mastercard and Visa and, Apple said, the six biggest issuing banks in the US. We’re not totally sure what issuing banks are, to be honest, but here’s what Wikipedia has to say on the subject.

The list of Apple Pay-supporting banks includes JPMorgan Chase, Bank of America and Citigroup, but we understand that Apple has set up partnerships with enough banks to cover most credit cards in the US. Coverage is likely to be less comprehensive outside the US, at least at first, but Apple obviously has considerable influence.

Later this year Apple says it will add support from Barclaycard, Navy Federal Credit Union, PNC, USAA and US Bank.

UK Apple fans will want to know about banks on this side of the pond, of course: we list participating UK banks a little further up.

You can find out whether a specific bank supports Apple Pay by using the website Can I Apple Pay? Or you can quickly scan this list of Apple Pay-supporting banks:

Banks that support Apple Pay

- A+ Federal Credit Union

- Amegy Bank of Texas

- America First Credit Union

- American Express

- Associated Bank

- Bank of America

- Barclaycard

- BB&T (Branch Banking & Trust)

- Bethpage Federal Credit Union

- Black Hills Federal Credit Union

- California Bank & Trust

- Capital One

- Chase

- Citi

- Commerce Bank

- Connex Credit Union

- Consumers Credit Union

- Customers Bank

- Cyprus Federal Credit Union

- Dupaco Community Credit Union

- FAIRWINDS Credit Union

- First Tennessee Bank

- Fremont Bank

- Goldenwest FCU

- Huntington Bank

- Idaho Central Credit Union

- J.P. Morgan

- KeyPoint Credit Union

- L & N Federal Credit Union

- M&T Bank

- MasterCard

- Meijer Credit Union

- Merrill Lynch

- Mountain America Credit Union

- National Bank of Arizona

- National Institutes of Health FCU

- Navy Federal Credit Union

- Nevada State Bank

- Partners Federal Credit Union

- PNC

- Regions Bank

- Security Service Federal Credit Union

- SunTrust

- TCF National Bank

- TD Bank N.A.

- The Bank of Greene County

- U.S. Bank

- U.S. Trust

- USAA

- UW Credit Union

- Vectra Bank

- Virginia Credit Union

- Visa

- Wells Fargo

- WesBanco Bank

- Western Union

- Zions First National Bank

Here’s a full list of Apple Pay participating issuers.

American Express is one of the biggest names on there, and snagging big fish like that will be critical in ensuring that Apple Pay achieves the critical mass it needs to become an accepted payment standard.

Which UK shops and retailers will support Apple Pay?

Apple has boasted that Apple Pay will be available at more locations for its launch UK than it was for the US launch – and there some big names on the list. Marks and Spencers and Waitrose were two names that Apple picked out at the announcements – being, we’d guess, two brands that seem particularly British to an international audience – but Boots, Lidl, Starbucks, Subway and Liberty are also on the list.

Eagle-eyed readers will notice that Waitrose and Lidl, while recognisable names, are not the top names in the supermarket game, and it seems that Tesco, Sainsbury and the rest are waiting to see how things go, or hedging their bets with other payment systems. We imagine that if Apple Pay is as popular here as it is in the States, they’ll join up soon enough.

TfL (Transport for London) will support Apple Pay, too, so you’ll be able to pay for Tube and bus journeys with your iPhone or Apple Watch.

Click here for a full (and expanding) list of UK shops and apps that work with Apple Pay.

…and which US shops support Apple Pay?

At the original launch, Eddie Cue said that there are 220,000 contactless payment points where you’ll be able to use Apple Pay, and that Apple is working with large retailers including Macy’s, Bloomingdales, Walgreens, Duane Reade, Staples, Subway, McDonalds, Disney Stores, Nike, Toys R Us, Sephora, Petco and Whole Foods. And you can use Apple Pay in Apple Stores, of course.

Above: excerpt from Apple’s guide to Apple Pay for shops that wish to accept the service

Here is a list of Apple Pay-ready shops:

Bricks-and-mortar retail stores that accept Apple Pay:

- Aeropostale

- American Eagle Outfitters

- Babies ‘R’ Us

- Bi-Lo

- BJ’s Wholesale Club

- Bloomingdale’s

- Champs Sports

- Chevron and Texaco, including retail stores like ExtraMile

- Disney Store

- Duane Reade

- ExtraMile

- FoodMaxx

- Foot Locker, including Kids Foot Locker, Lady Foot Locker, House of Hoops, and Run by Foot Locker

- Footaction

- Harveys Supermarket

- Jewel Osco

- Lucky

- Macy’s

- McDonald’s

- Meijer

- Nike

- Office Depot

- Panera Bread

- Petco and Unleashed by Petco

- RadioShack

- Save Mart Supermarkets

- Sephora

- Shaws

- Six:02

- Sports Authority

- Sprouts Farmers Market

- Staples

- Star Market

- Subway

- Texaco

- Toys ‘R’ Us

- United Supermarkets

- Unleashed!

- Walgreens

- Wegmans

- Whole Foods Market

- Winn-Dixie

Shops that will roll out Apple Pay compatibility in 2015:

- Acme

- Albertsons

- Anthropologie

- Free People

- Urban Outfitters

- Walt Disney World Resort

We’ll update this list as companies join (or leave) the Apple Pay family.

While Apple Pay didn’t get its UK launch at the Apple Watch event (as we had hoped), Tim Cook did offer some facts and figures to let us know how the service is getting on; and one of the more interesting titbits was the fact that Coke is now offering Apple Pay-compatible vending machines. (Not just a few to demonstrate the concept, either – there are currently 40,000 of them, and this is predicted to rise to 100,000 within the year.) No more flattening crinkled dollar bills, Cook said.

Oh, and here’s one more – although it can’t really be described as ‘bricks and mortar’. The US airline JetBlue has announced that passengers can use Apple Pay to buy drinks and other onboard items on some of its flights. Could be convenient for those who find it difficult to dig their wallets out while confined to a cramped economy-class seat.

This isn’t terribly exciting news for us here in the UK, because JetBlue serves only destinations across the Americas. But the way these things tend to work in air travel is by a process of peer pressure: if one airline is offering a new gimmick then the others often feel the need to follow suit. So who knows: an airline with European connections may adopt the service in the near future.

The next airline to offer Apple Pay support could easily be United Airlines, which recently equipped 23,000 of its flight attendants with iPhone 6 Plus handsets.

Which apps let you use Apple Pay?

You can use Apple Pay in apps, including non-Apple apps – the more the merrier, as far as Apple’s concerned.

A good range of e-commerce apps work with Apple Pay, including Groupon, Uber (the taxi app that caused so much furore among London cabbies), the Starbucks, Disney and Target apps, and OpenTable.

But, in keeping with its recent open approach to developers, Apple is making overtures to encourage more apps to be built to support Apple Pay. For more insight on how app developers can work with Apple Pay, take a look at the company’s introduction: Getting started with Apple Pay [pdf].

Here’s a list of apps that presently support Apple Pay:

Apps that work with Apple Pay

- 20Stamps

- Airbnb

- Apple Store app

- Chairish

- Dapper

- Dealflicks Movies

- Disney Store

- Drync

- Eventbrite

- Fancy

- Flextrip

- Gametime

- GoldieBlox and the Movie Machine

- Groupon

- Hotel Tonight

- Houzz

- Indiegogo

- Instacart

- JackThreads

- Keep Shopping

- Levi’s Stadium

- LIFX

- Lyft

- Merchbar

- MLB.com

- OpenTable

- Panera Bread

- Pose

- Postmates

- Priceline

- Print Studio

- Sephora

- Sosh

- SpotHero – Parking Deals

- Spring

- Staples

- Stayful

- StubHub!

- Target

- ThirdLove

- Threadflip

- Ticketmaster

- TouchOfModern

- Uber

And Apple says the Starbucks app will soon be compatible with Apple Pay too.

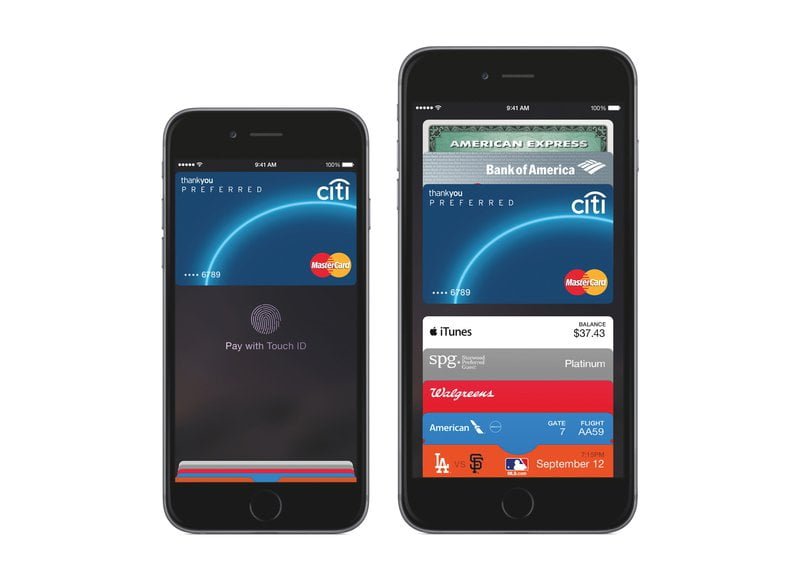

How to set up and use Apple Pay

At its iPhone 6/iPhone 6 Plus launch event last September, Apple also debuted what it called “an entirely new category of service”: a mobile payments system called Apple Pay. This new mobile payment service is basically designed to let you pay for things with your iPhone (or Apple Watch or iPad, in slightly different and more limited ways). Sorry, it will “change the way you pay for things forever”.

(If you want to know what other Apple brands and related tech terms mean, take a look at our Apple user’s jargon buster.)

You will need to set up Apple Pay using the Passbook app (which will be renamed as Wallet when iOS 9 launches – here’s how to use Apple Wallet app). Apple Pay has a transaction limit in the UK of £20, which is the same with any NFC-based payment system, but that figure is expected to grow in the coming months – indeed, some UK shops have already installed a software update that allows their readers to process larger transactions when verified by Apple Pay’s Touch ID.

We walk you through Apple Pay setup in the next section.

How to set up & use Apple Pay: How do I get started with Apple Pay?

Setting up Apple Pay is pretty straightforward, although one glitch has been observed.

First of all, if you’ve got a credit or debit card linked to your Apple ID already (for making iTunes and App Store purchases), you can just carry on using that with Apple Pay. Alternatively, you can add a new card to your account.

Either way, launch Passbook (or Wallet, once iOS 9 launches in the autumn) and select Add Credit or Debit Card, then “Add Another Card”. Fill in the required fields. If the card you’re setting up is already associated with iTunes this process will simply require you to enter the security code, but a new card will take a bit more work.

Instead of typing in all those fiddly numbers, you can use your iPhone camera to ‘read’ the information on your card. The software will walk you through the process: you just need to line up your card in the frame, then add a few additional details afterwards, such as the security code.

Tap next. At this point (even if it’s a card that was linked to your Apple ID already) your iPhone will need to verify your card. This process varies from bank to bank. Tap Next after verification is complete, and you’re ready to go.

We go over this process in a bit more detail in our article How to set up and use Apple Pay in the UK.

If the option to add your cards doesn’t appear, there’s a fix available. Simply go to Settings > General > Language & Region and change the region from United Kingdom to United States and then restart your iPhone. Once restarted, you should be able to add (supported) bank cards to be used with Apple Pay.

Once you’ve added your bank cards, simply head back into the Settings app, change the region back to United Kingdom and restart your phone once more.

How to set up & use Apple Pay: How does Apple Pay work?

Your Touch ID fingerprint scanner is key to the whole thing, but you will also need a specific NFC antenna that is built into certain Apple devices.

If the shop you’re in supports Apple Pay (more on that later), they will have a little sensor by the till. You put your iPhone on the sensor, put your finger on the Touch ID fingerprint scanner to identify yourself, and that’s it.

The underlying technology is NFC (which stands for ‘Near Field Communication’), a standard that Android phones have used for mobile payments for some time. Google Wallet is based on NFC. Indeed, NFC has been around since the late 1990s, appearing in key fobs, building passes, Oyster cards and similar.

There are NFC antennae in the iPhone 6 and iPhone 6 Plus, but not in any earlier iPhones. There are also NFC chips in the iPad Air 2 and iPad mini 3, but they appear to be deactivated for the time being; no iPad is able to use the full, in-store version of Apple Pay. But we’ll get into all that later in this article.

Source: Apple’s developer-focused introduction, Getting started with Apple Pay [pdf]

How to use Apple Pay: How does Apple make money out of Apple Pay?

Not by collecting purchase or customer data, apparently. (We discuss the privacy aspects of Apple Pay further down.)

Apple says it will levy a fee on each purchase from the banks involved in the system. Apple insists it won’t charge users, merchants or developers: in its new Apple Pay FAQs, the company confirms that it “doesn’t charge any additional fees” for merchants to accept Apple Pay.

How to set up & use Apple Pay: Is Apple Pay easy to use?

Apple Pay has only just launched in the UK, but our experience so far suggests that it’s exactly as simple and speedy as Apple led us to believe. Wild rumours suggested that Apple Pay took up to seven seconds to beep its owner into the London Underground (more than long enough to create vast discontent in the queue behind you) but our experience suggests otherwise: it seems to be more or less the same speed as any other contactless payment method.

For a deeper (and longer-term) write-up of Apple Pay and its general convenience and ease of use, we turn to our American sister site Macworld US, which has reported extensively on the customer experience.

“I didn’t experience any cashier confusion or glitches when I used Apple Pay, except when I tried to buy pumpkin-shaped Snickers at Rite Aid,” writes one of our US colleagues. It’s another world over there, isn’t it?

More seriously, the writers found the service broadly user-friendly and easy to master. “It’s secure, easy to use, and quick,” they observe. “Rummaging through your bag or pocket for your phone takes considerably less time than digging for your wallet and then fumbling through until you find your card.”

But there were some problems, at that early stage in Apple Pay’s US adoption, getting shop workers to grasp the way the system works. Processing refunds proved to be particularly tricky.

“Since Apple Pay randomises the card number for merchants and prints out that fake card number on the receipt, I had a feeling that returns would be problematic, even though Apple insists it wouldn’t be. As it turns out, I was right… and I was wrong,” writes Leah Yamshon.

“There was a brief hiccup at American Eagle, when the cashier asked if he could see my credit card to confirm that the last four digits matched what was on my receipt (just like my old store!). I explained that I had used Apple Pay, and that the receipt wouldn’t match my card because of the system’s security measures. Stumped, the associate called his manager over, and we filled her in what was going on. The manager told me that she still needed to see my actual credit card to make the return, explaining that I couldn’t get a refund without swiping the card. It was a learning experience for both of us.”

Yamshon wisely predicts that hiccups of this sort are sure to ease as Apple Pay becomes more widely understood. We should therefore brace ourselves for difficulties in the early months after Apple Pay launches in the UK, but at the same time be reaassured that they won’t last forever.

Read Macworld US’s full hands-on test of Apple Pay: Two coasts, 10 days: Macworld’s thorough field test of Apple Pay

Here’s a couple of mini videos showing how easy Apple Pay is to use:

How to set up & use Apple Pay: How do refunds and returns work?

As our colleagues describe in their hands-on review above, there’s likely to be some confusion about processing refunds and returns, and for the first few months after Apple Pay launches in the UK you may find yourself guiding the shop assistant as much as they do you.

But it shouldn’t be too hard in practice. Apple explains:

“How do I process returns with Apple Pay?

“Use the Device Account Number to find the purchase and process the return, just like you would with a traditional credit or debit card payment. To see the last four or five digits of the Device Account Number, ask the customer to go to Passbook, tap the card, and tap i on the lower-right corner of the display.

“You can also have the customer hold their iPhone 6 or iPhone 6 Plus near the reader, select the card they used to make the original payment, and authorize the return with Touch ID or passcode.”

In other words, it should be as simple as touching your iPhone to the reader – but we’ll see how it works out ‘on the street’.

Read next: ApplePay aims to replace your wallet with an iPhone

How to set up & use Apple Pay: Can I use Apple Pay online?

Yes. Apple called this “one-touch checkout”, since there’s far less need to enter data than in most online payment systems.

Apple Pay security: How does Apple Pay safeguard my privacy and protect me against fraud?

Is Apple Pay secure? The short answer is yes, we’re pretty sure it is – and it’s almost certainly more secure than previous payment methods. But the long answer is a bit more complicated.

It’s impossible to say with any certainty that Apple Pay’s security is watertight until we’ve tested it out for ourselves over a decent period of time. But Apple execs have fallen over themselves to insist that security was a priority from day one.

If the iPhone is lost or stolen, for instance, you can use Find My iPhone to suspend all payments from that device. There’s no need to cancel the credit card, because the number isn’t stored on the device, as we already mentioned – we can thank tokenisation for that.

Your credit card number isn’t given to the merchant. What you’re doing, rather, is creating a device-only account number and storing it in thesecure element. “You use a one-time payment number and a dynamic security code,” said Eddie Cue.

Read next: Is Apple Pay safe? Find out if you’re at risk by using Apple Pay

The secure element is a hardware component – a chip inside the iPhone 6 and iPhone 6 Plus where sensitive data can be stored. Secure element is a generic term for protected memory on smart cards, and the data on the secure element isn’t even accessible to iOS (it’s only accessed via a random code during the transaction). Hackers wouldn’t be able to get hold of your credit card details if they hacked your phone. And it’s apparently able to sense if someone is dismantling the phone in an attempt to access the data on the secure element.

It’s also worth mentioning that Apple has a strong record when it comes to payment systems. Even the biggest payment platforms suffer compromises from time to time, but Apple has built up customer trust when purchasing through iTunes and the App Stores.

Apple hasn’t been immune from security problems, admittedly, with the nude celebrity photo leak from iCloud recently put at its door. (The company did claim that this was the result of a targeted attack on password and usernames, mind you, rather than a failure of iCloud’s security systems.) But even if some pundits felt its initial response to the leak was lacklustre (or even victim-blaming), it then responded by insisting that security will be beefed up in iOS 8: pushing two-factor authentication and sending additional security warnings. Apple is taking security seriously.

Incidentally, Tim Cook pointed out that the system Apple Pay is proposing to replace isn’t exactly super-secure itself, since it’s easy to lose a credit card or have it compromised.

“This whole process is based on this little piece of plastic,” he said. “And whether it’s a credit or debit card, we’re totally reliant on the exposed numbers and the outdated and vulnerable magnetic strip. Which, by the way, is five decades old. And the security codes, which aren’t that secure.”

We address this concern in still more detail in separate articles: Here are the security questions raised by Apple Pay and Apple Pay’s security pros and cons.

Apple Pay security: Could a hacker steal my credit-card details from the iPhone?

Apparently not. As a security measure, the credit card details aren’t actually stored on the iPhone, or on Apple’s servers. (It may be worth mentioning that Google Wallet works differently: Google keeps your card details on its servers.)

Apple says the payment network or issuing bank will provide a Device Account Number, using a technique called tokenisation: replacing a sensitive piece of data with a random piece of data that typically has the same format. Tokenisation reduces or removes the need to update existing systems that require a credit-card number, without exposing the real number to theft.

But here’s one last word on security. One site reckons that Apple Pay and other electronic wallet technologies are actually making it easy to commit credit-card fraud. It reports that criminals are bypassing the security checks by using the old-fashioned fraud method – buying hacked credit-card details – and then setting these up on an iPhone’s Apple Pay system, which then allows them to pay for goods without any identification checks beyond the fingerprint – which won’t be a problem, because it’s the fraudster’s phone, even though it’s not his credit card.

Obviously this is hardly Apple’s fault, nor is it really a new problem – it simply makes the fraud process slightly smoother for criminals who have already got their victim’s credit-card details. Read more details for yourself here.

Read next: Fraud comes to headlines about Apple Pay

Apple Pay security: If I’m hit by fraud on Apple Pay, will I be liable for any losses?

The situation should remain much the same as when using credit or debit cards on their own. In its guide for merchants, Apple explains about fraud liability:

“Will I [the merchant] be liable for fraud on Apple Pay transactions?

“Apple Pay transactions are treated in the same way as your current credit and debit transactions. You’ll have the same liability rules applied to Apple Pay transactions.”

Regulations in the UK dictate that cardholders are not held financially liable for any fraud on their cards, “provided you have not acted fraudulently or without reasonable care (e.g. you haven’t written down your PIN and haven’t disclosed it to someone else)”, and this will apply under Apple Pay too.

Payments made using Apple Pay in a shop are classified as card-present transactions, by the way. Payments made using Apple Pay within apps are card-not-present transactions. This has some ramifications in terms of liability if something goes wrong, but either way it shouldn’t be you picking up the tab.

More information on card fraud liability here and here.

Apple Pay security: What about privacy – can I be tracked if I pay using Apple Pay?

Apparently not. Eddie Cue insisted: “Security is at the core of Apple Pay; but so is privacy. We are not in the business of collecting your data.” (Was that a shot at Google?)

When you go to a shop, Apple doesn’t get to know what you bought, how much you paid for it, or any other personal details. The guy behind the counter doesn’t get to see your name or your credit card number – all of which are potential weak spots of the current system, under which cards are occasionally cloned and ripped off.

Read next: Apple’s mobile payment rolling out despite problems

Which iPhones and other Apple devices work with Apple Pay?

The iPhone 6 and the iPhone 6 Plus. As well as the Touch ID fingerprint scanner that’s integral to Apple Pay’s identification system, the new iPhones have a dedicated NFC antenna built across the top.

Obviously we’d expect future iPhones to support the service too. If you’re wondering about them, read our iPhone 7 rumours, our iPhone 6s rumoursand our iPhone 6c rumours.

Can I use the Apple Watch with Apple Pay?

Apple Pay works with the Apple Watch too, which is a thoroughly appealing prospect.

Apple states that the watch will have to be paired with an iPhone (the 5 or later) in order to do this. Here’s how Apple describes the process of paying with an Apple Watch:

“Double-click to pay and go. You can pay with Apple Watch – just double-click the button next to the Digital Crown and hold the face of your Apple Watch near the contactless reader. A gentle pulse and beep confirm that your payment information was sent.”

Do any iPads support Apple Pay?

Yes, to a limited extent. The iPad Air 2 and iPad mini 3 can be used for fingerprint-secured online payments via Apple Pay, but not for the one-touch payment in shops with NFC sensors. Then again, it’s hard to imagine many people pulling out a full-size iPad to pay for a coffee.

Most tech sites (this one included) had speculated that the new iPads simply didn’t include an NFC antenna, but that theory has been exploded: iFixit has done a teardown on each of the new models and, sure enough, found a mysterious NFC module.

It’s unclear, then, why the iPad Air 2 and iPad mini 3 can’t use the full version of Apple Pay – nor why Apple bothered to include an NFC antenna in these devices. It’s possible that Apple will activate the feature down the line. Or it may have other functions in mind for the NFC feature, such as device-to-device money transfers or smart home controls.

And will any Macs support Apple Pay?

Maybe the online version of Apple Pay will be added to the Mac line at some point. As with the iPads, it’s clearly hard to imagine even a Mac mini or supersvelte MacBook Air being whipped out at the till in Starbucks, but this would be an immense convenience for online shopping.

Sure enough, there has been considerable speculation about Touch ID being added to Apple’s Mac line-up at some point in the future – specific Touch ID rumours attached to the next MacBook Air, although that turned out to be wrong.

What rival services will Apple Pay have to beat?

As usual when discussing Apple rivals, two names leap to mind: Google and Samsung. There are a few other services out there, but we’ll deal with those two first.

Google Wallet first. This has been around for a few years now, but it’s a little different to Apple Pay. For one thing, it lets you store debit and credit card details on your mobile, whereas Apple Pay uses tokenisation to ensure that the details aren’t stored on the iPhone. (There has been some criticism of Google Wallet’s security, but it should be pointed out that the company has implemented security measures including the storing of the details in the NFC chip’s secure element.) And Google Wallet offers wider compatibility than Apple Pay. See: What you need to know about Google Wallet.

By the way, Google Wallet still hasn’t launched in the UK, and our colleagues on PC Advisor don’t think it will in the foreseeable future.

Samsung Pay, by contrast, hasn’t launched at all yet; its predecessor, Samsung Wallet, was at time of writing scheduled to close down in late June 2015 to make way for this new service. (Samsung cited poor adoption.) Samsung Pay more closely matches Apple Pay (cynics might accuse Samsung of copycat behaviour, but it actually acquired its way into the mobile payment arena) and should offer similar security and ease of use. We compare Apple Pay and Samsung Pay (or what we know about the latter so far) in a dedicated article: How will Samsung Pay compare to Apple Pay?

What other mobile payments services are there? There’s CurrentC, whose prospects a colleague discusses here: The Macalope: Which is doomed, Apple Pay or CurrentC? And Amazon had an app called Wallet that ran in beta for a while, but that appears to have been shelved now. Finally, as we mentioned in the dedicated Barclays section, bPay is another rival to Apple Pay but has a number of shortcomings by comparison.

We think Google Wallet is the main challenger in this department (in fact, given how long it’s been around, we should probably say that Apple Pay is the challenger to Google Wallet). But the thing about mobile payments is that competition will be good for all the participants, at least until it becomes mainstream.

Adverts by each of the services, and seeing other people use them, will combine to increase general awareness that paying in shops with your mobile is something that we do now, and help to ease worries about security, and feelings of embarrassment about being a show-off.

Why isn’t Apple Pay called iWallet?

We don’t know. But what with the iWatch turning out to be plain old Apple Watch, some pundits are wondering if Apple is cooling on the prefix. It was becoming a little bit of a cliche.

[source :-macworld]